I. Introduction

A crypto bubble occurs when the price of a cryptocurrency rises rapidly and abruptly falls, resulting in significant losses for investors. Crypto bubbles are similar to other financial projections but differ because they are digital and can happen quickly.

Importance of understanding Crypto Bubbles

Anyone interested in investing in cryptocurrencies must first understand crypto bubbles. Cryptocurrencies are still a new asset class that has yet to be tested, so investors who aren’t careful can easily get caught up in the hype, speculation, and market manipulation. Understanding crypto bubbles allows investors to recognize the signs of a potential bubble and protect their investments.

Crypto Bubbles: Overview

This article will examine crypto bubbles’ history, causes, consequences, and how to spot and avoid them. It will start with a summary of history’s most crucial crypto bubbles, such as the Bitcoin and Ethereum bubbles of 2017. The article will then discuss what causes cryptocurrency bubbles, such as hype and speculation, a lack of regulation, and market manipulation. The article will also talk about the effects of crypto bubbles, like how investors lose money, how it hurts the reputation of cryptocurrencies, and how it slows down innovation and growth in the crypto industry. Even Though AI is helping cryptocurrency. The article will show investors how to spot and avoid crypto bubbles through technical analysis, market sentiment analysis, and historical price analysis. Finally, the article will discuss avoiding crypto bubbles, such as conducting extensive research before investing, diversifying one’s portfolio, avoiding FOMO (fear of missing out), and monitoring market trends and news. Readers will better understand crypto bubbles by the end of the article and be better prepared to invest wisely in the crypto industry.

II. History of Crypto Bubbles

A. First Crypto Bubble: Bitcoin in 2011

In 2011, Bitcoin’s price went from less than $1 to more than $30 before falling to just over $2. This was the first significant cryptocurrency bubble. People speculated and got excited about Bitcoin’s potential as a new form of digital currency, which led to this bubble.

B. Bitcoin Bubble of 2013

In 2013, the price of Bitcoin went from about $13 to more than $1,100 before dropping to everywhere $500. More attention from the media and small investors worsened the bubble, leading to a rise in demand and price.

C. Crypto Bubbles: Ethereum 2017

In 2017, a bubble developed in Ethereum, the second-largest cryptocurrency by market capitalization. Ethereum’s price increased from about $10 at the beginning of the year to over $1,400 in December 2017, then declined to $100. The hype and rumors surrounding the potential of Ethereum’s blockchain technology fueled the bubble.

D. Crypto Bubbles: Bitcoin 2017

The price of Bitcoin rose from around $1,000 at the beginning of the year to a peak of almost $20,000 in December before plummeting to about $3,000 in early 2018. This is the most well-known cryptocurrency bubble to date. More media coverage, retail investors’ fear of missing out (FOMO), and the start of Bitcoin futures trading on major exchanges helped the bubble grow.

E. Other notable Crypto Bubbles

In addition to the ones already mentioned, several other well-known crypto bubbles exist. These include the Dogecoin bubble in 2021, the 2017 Bitcoin Cash bubble, and the 2018 Ripple bubble.

Overall, the history of cryptocurrency bubbles shows that cryptocurrencies are unpredictable investments, with prices that rise and fall quickly. While many other investors lost a lot of money by investing in cryptocurrencies during these bubbles, some made significant profits. Therefore, investors must use caution and conduct due diligence before making a cryptocurrency investment.

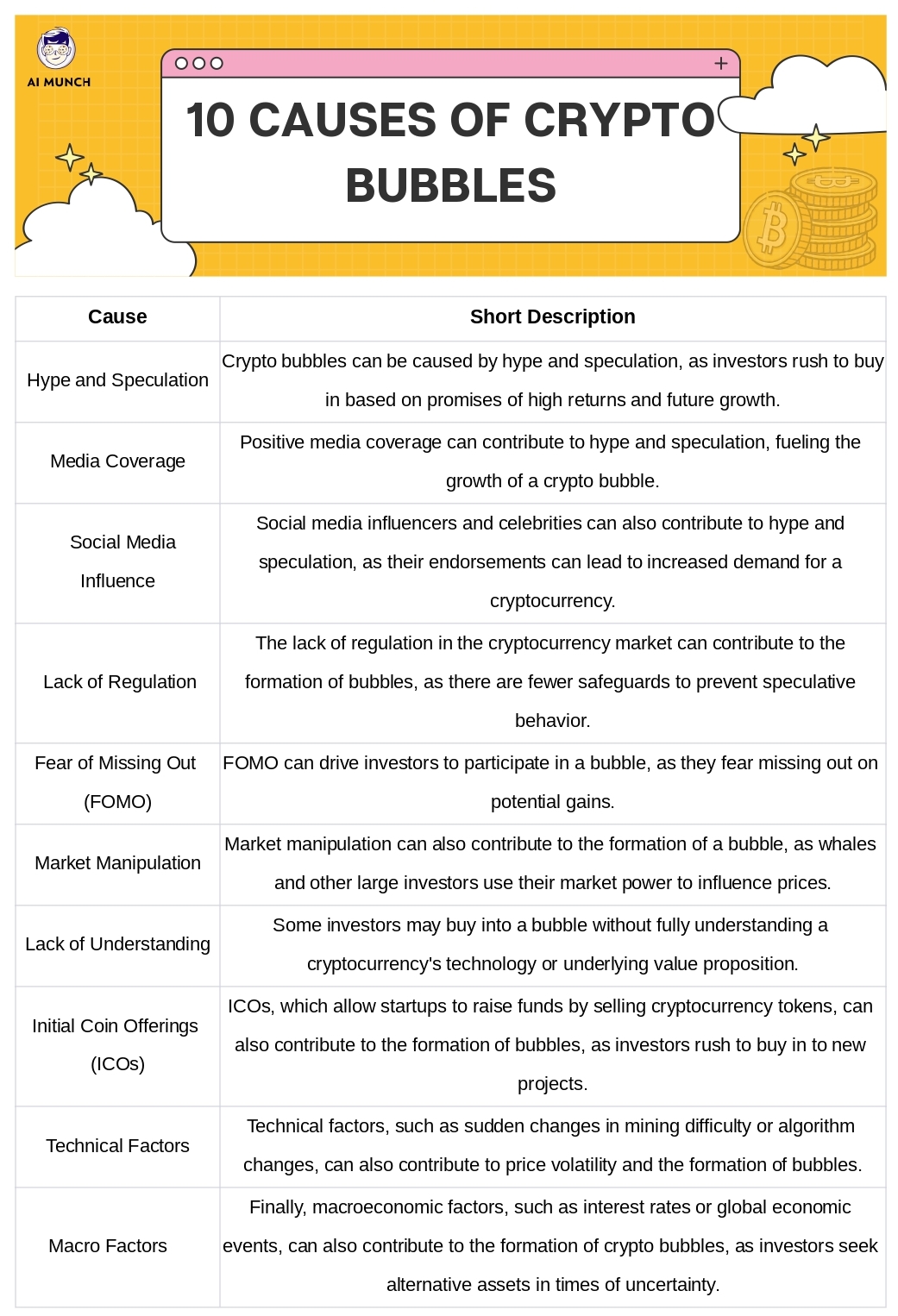

III. Causes of Crypto Bubbles

A. Hype and speculation

Hype and speculation are frequently the roots of cryptocurrency bubbles. Because cryptocurrencies are a new asset class with a bit of history, there is often a lot of uncertainty and speculation about how much they might be worth. A bubble can happen when investors overestimate a cryptocurrency’s potential and drive its price to levels that can’t stay. People or organizations that want the value of a particular cryptocurrency to go up may stir up hype and speculation about it.

B. Media coverage and social media influence

Media attention and social media influence can also significantly fuel cryptocurrency bubbles. Major news outlets writing about a cryptocurrency’s potential or influential people promoting it on social media can cause demand and price to increase. This could result in a self-fulfilling prophecy, where the cryptocurrency price keeps growing because people believe it will keep doing so.

C. Lack of regulation and oversight

Another element that may cause crypto bubbles is more regulation and oversight in the cryptocurrency sector. If cryptocurrencies aren’t regulated well, prices could be manipulated, fraud could happen, and other crimes could happen. A lack of regulation makes it hard for investors to determine how much a particular cryptocurrency is worth, leading to overvaluation and bubbles.

D. Fear of missing out (FOMO)

Fear of missing out (FOMO) is a psychological factor that can play a significant role in crypto bubbles. Investors who observe a particular cryptocurrency’s price increasing quickly might become anxious about missing out on potential gains and entering the market without conducting adequate due diligence or comprehending the risks involved. This could result in a spike in demand and an increase in price that would fuel a bubble.

E. Market manipulation

Another element that may contribute to crypto bubbles is market manipulation. Because they are smaller than traditional financial markets, cryptocurrencies are more prone to manipulation by big investors or groups of investors. By using pump-and-dump schemes, wash trading, or spoofing, these investors can artificially drive up the price of a particular cryptocurrency, making a bubble.

Overall, there are numerous and complex factors that contribute to crypto bubbles. While some bubbles may result from a single element, such as hype or media attention, others may result from a combination of factors, such as market manipulation and a lack of regulation. Due to these reasons, it is crucial for investors to be aware of these factors and to use caution when making cryptocurrency investments.

IV. Consequences of Crypto Bubbles

A. Financial losses for investors

One of the worst things about cryptocurrency bubbles is that investors could lose money. When a cryptocurrency bubble pops, its price may drop quickly, leaving investors who bought at its height with sizable losses. Investors might sometimes lose everything they invested, putting them in financial ruin.

B. Negative impact on the reputation of Cryptocurrencies

Cryptocurrency bubbles may also harm the standing of cryptocurrencies as a whole. It may be more challenging for legitimate projects and businesses in the cryptocurrency industry to gain traction when a bubble bursts due to negative media coverage and public perception of cryptocurrencies. Due to this bad reputation, there may be more scrutiny and regulation, which could slow down the growth and development of the industry.

C. Stifling innovation and growth in the Crypto industry

In the crypto industry, innovation and growth can be stifled by crypto bubbles. Investors may become more risk-averse and less likely to invest in new or innovative projects after losing money in a bubble. This may make it harder for start-ups and small businesses in the sector to raise capital and expand.

D. Impact on the wider financial market

Cryptocurrency bubbles occasionally affect the more significant financial market. When a bubble bursts, investors may attempt to limit their losses by selling their remaining holdings in other asset classes. Also, using leverage or margin trading can worsen a crypto bubble in the cryptocurrency market, which could pose a systemic risk to the entire financial system.

V. How to Identify Crypto Bubbles

A. Technical analysis indicators

Using technical analysis indicators is one way to spot a crypto bubble. These may include indicators that can help traders spot overbought or oversold market conditions, such as the relative strength index (RSI), moving averages, and Bollinger Bands. When these signs show that a particular cryptocurrency has been bought too much, it could start a bubble.

B. Market Sentiment Analysis

Analysis of market sentiment can also be used to spot a crypto bubble. This entails analyzing social media sentiment, news coverage, and other factors to ascertain investor sentiment and perception of a specific cryptocurrency. When the view is overly upbeat, a bubble might start to form.

C. Historical Price Analysis

Finally, a crypto bubble can be detected using historical price analysis. Investors can see patterns and trends in the price history of a cryptocurrency that show a drop is coming. For example, if the price of a cryptocurrency has gone up quickly in a short time, this could be a sign of a bubble.

In conclusion, crypto market investors face a sizable risk from bubbles. Investors can reduce risk and make wiser investment decisions by becoming familiar with the causes, effects, and ways to spot these bubbles. To lessen the possibility of future bubbles forming, regulators and industry participants must also take action to encourage transparency and accountability in the crypto market.

VI. How to Avoid Crypto Bubbles

A. Do your research before investing

To prevent crypto bubbles, start by doing your homework before investing. Check the company’s website that makes the product you’re interested in. Through thorough due diligence, investors can identify potential risks and make better investment decisions.

B. Diversify your portfolio

AI help with crypto mining as well as investing and improving portfolio. The diversification of your portfolio is a crucial tactic for avoiding cryptocurrency bubbles. Investing in various cryptocurrencies and other assets can lower your overall risk exposure. By diversifying your portfolio, you can lessen the effects of any individual bubble or market downturn.

C. Avoid FOMO and invest with a long-term strategy

Cryptocurrency bubbles frequently result from investors rushing to invest in a hot market or asset out of fear of missing out (FOMO). It’s crucial to invest with a long-term strategy in mind to avoid succumbing to FOMO. This entails staying away from short-term speculation and focusing on the cryptocurrency investment you’re making’s fundamentals.

D. Monitor market trends and news

It is crucial to keep an eye on market trends and news to stay current on the most recent developments in the cryptocurrency market. Investors can spot potential risks and opportunities and make better investment decisions by keeping up with recent news and trends.

VII. Crypto Bubbles and AI

Although AI and crypto bubbles are two separate technological fields, they can interact excitingly. Analyzing market data and patterns using artificial intelligence (AI) may detect bubbles earlier and lessen their effects.

Sentiment analysis is one potential use of AI in the cryptocurrency market. AI algorithms can be taught to look at news and social media data to determine how people feel about the market. This could show early signs of a crypto bubble forming. By doing this, investors can change their investment plans before the bubble bursts, which could help them lose less money.

Technical analysis is another area in which AI could be used in cryptocurrency. To help investors spot potential bubbles or market trends, AI algorithms can be trained to recognize patterns in price movements. This could also make it easier to spot investment opportunities, letting investors take advantage of market trends before most people notice them.

It’s important to remember that AI is not a silver bullet for spotting and avoiding crypto bubbles. When investing in cryptocurrencies, it’s important to be careful and thorough and not just rely on AI algorithms or other types of automated analysis.

Artificial intelligence could be useful for learning about and researching the cryptocurrency market. However, it should be used in addition to other research methods and investor education. By combining the power of AI with human insight and critical thinking, investors could better find their way around the complicated and quickly changing world of cryptocurrencies.

VIII. Conclusion

Cryptocurrency bubbles pose a serious threat to investors in the market. But investors can lower their risk and make better investment choices if they understand what causes and causes these bubbles and how to spot and avoid them. When investing in cryptocurrency, it’s essential to be careful, do your research, diversify your portfolio, avoid short-term speculation, and stay up to date on news and trends in the industry.

Regulators and industry participants must support transparency and accountability in the market as the cryptocurrency sector develops and matures. This means making it less likely that bubbles will form in the future and teaching investors about the pros and cons of investing in cryptocurrencies.

In the end, regulators, industry participants, and investors must participate responsibly and intelligently for the crypto industry to succeed. We can contribute to ensuring the long-term success and sustainability of the cryptocurrency market by banding together to promote transparency, accountability, and responsible investing.

FAQs

Cryptocurrency bubbles happen when the prices of cryptocurrencies rise quickly and out of control because of hype and speculative hype. This often causes investors to rush into the market to buy cryptocurrencies. This demand drives up prices even more, creating a bubble. When the market eventually reaches saturation and demand falls, the bubble bursts, and prices drop dramatically.

For PC users, there are a variety of tracking and market analysis apps for cryptocurrencies that may have tools for keeping an eye on and anticipating potential bubbles. But it would be best to be careful and not rely on software to analyze or make predictions. Before you decide to invest in the cryptocurrency market, doing detailed research and analysis is a good idea.

A cryptocurrency bubble is when the value of one or more cryptocurrencies increases quickly and unsupportably due to hype and speculation. As a result, there will be a situation where the price is much higher than its intrinsic value, which will cause a price drop or “bursting” of the bubble later.

A cryptocurrency bubble has no set price because it can have a wide range in value depending on the specific market circumstances, level of hype and speculative activity, and the cryptocurrency or currencies in question. Cryptocurrency price bubbles usually lead to significant price increases and big price drops that make investors lose money. Be careful and thorough when investing in cryptocurrencies, especially when the market is very volatile.

Do you want to read more? Check out these articles.