I. Introduction

Traders and investors want to know, “How is artificial intelligence used in cryptocurrency investments?” What is meant by “artificial intelligence in cryptocurrency”? However, What are these actually? When machines are given the ability to learn, reason, and adapt, this is called Artificial Intelligence (AI). The process involves making intelligent computer programs and simulations that can look at vast amounts of data and do complicated tasks that were once thought to require human intelligence. Cryptocurrency, on the other hand, is a digital currency protected by cryptography. This makes it almost impossible to fake or double-spend. It only depends on a group to run. Instead, it uses blockchain technology to make sure that transactions are safe and that the system is reliable. Like many other fields, AI in cryptocurrency is not new.

Artificial intelligence (AI) in cryptocurrency trading has exploded in recent years. In the growing cryptocurrency market, huge amounts of trading data are sorted with AI’s help. Let’s have a brief look at: How is artificial intelligence used in cryptocurrency investments?

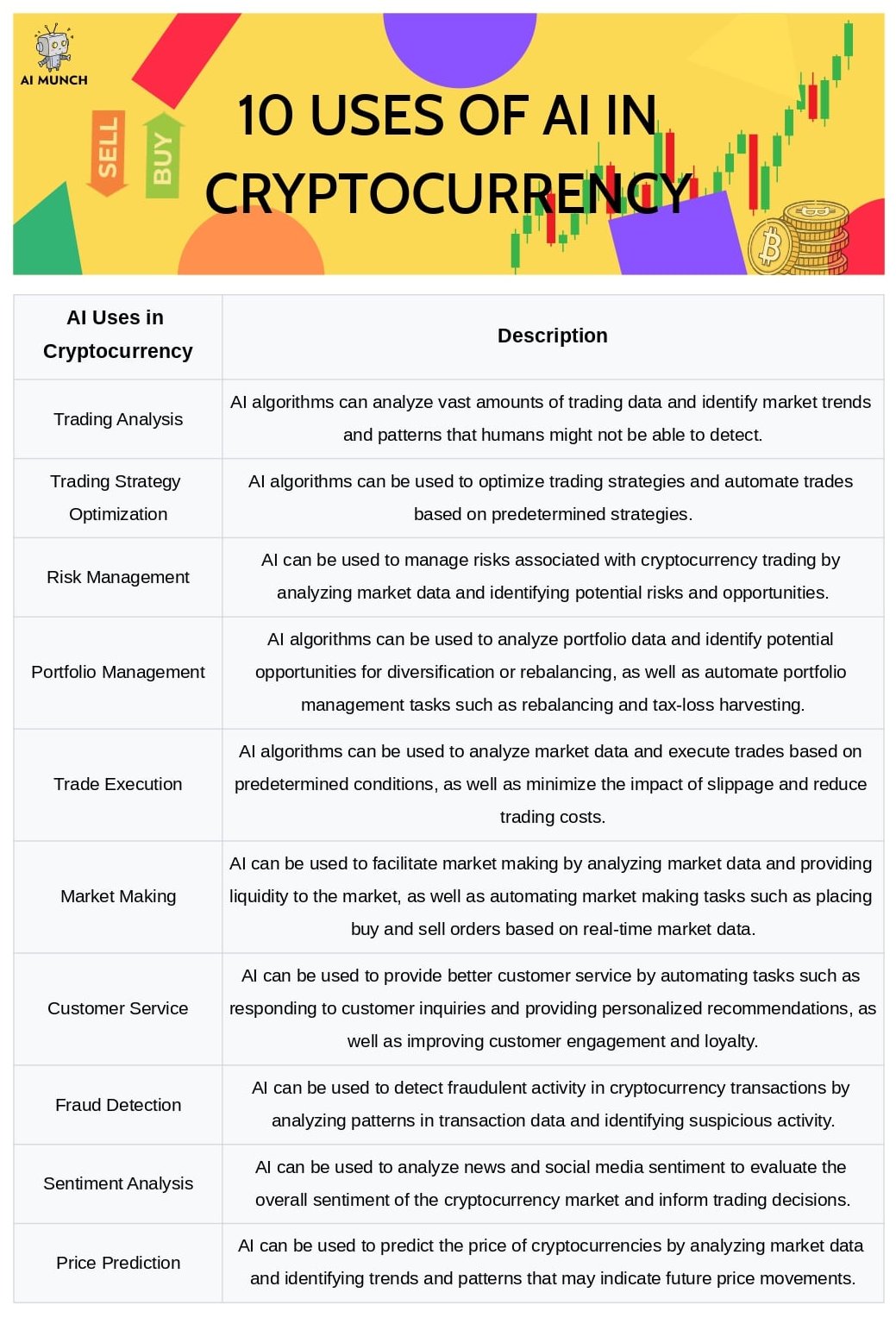

Ways AI is being used in cryptocurrency trading

- Trading Analysis: Market data, social media sentiment, and news sentiment are just some types of data that artificial intelligence algorithms can analyze for trading. Traders can use this analysis to spot market trends and patterns otherwise difficult, if not impossible, for humans to recognize.

- Trading Strategy Optimization: Algorithms trained by machine learning can sift through historical data in search of the most promising buy and sell indicators. To further reduce the possibility of human error and increase trading efficiency, AI can be used to automate trades based on predetermined strategies.

- Risk Management: With the help of AI, trading in cryptocurrencies can be made less risky by looking at market data for threats and opportunities. It can also be utilized to detect fraudulent or otherwise illegal trading practices.

- Portfolio Management: AI can be used to manage cryptocurrency portfolios by looking at data to find places to diversify and rebalance. Portfolio rebalancing, tax loss harvesting, and other portfolio management tasks can all be automated with its help.

- Trade Execution: AI can improve the efficiency of trade execution by looking at market data and making trades based on rules that have already been set. When doing so, you can lessen the slippage effect and reduce trading expenses.

- Market Making: Market making is aided by AI when it is used to analyze market data and when it is used to provide liquidity to the market. Also, it can automatically place buy and sell orders based on market data in real time, which is helpful for market makers.

- Customer Service: Artificial intelligence (AI) can make customer service better by automating everyday tasks like answering questions and making suggestions based on what each customer likes. There may be an increase in customer participation and loyalty as a result.

AI is impacting human society in certain ways, use of AI in finance is one of them. Ultimately, AI is changing cryptocurrency trading by creating new ways to make money and lowering market risks. As AI’s use in cryptocurrency trading continues to grow, we can expect even more cutting-edge ways to use it in the future.

II. AI in Cryptocurrency: Trading Analysis

We have read about how artificial intelligence is impacting our economy. Using AI in cryptocurrency trading is a big help because it lets traders quickly and accurately analyze vast amounts of trading data. Market data, social media sentiment, and news sentiment are just some data that AI algorithms can process in real-time. Traders can use this analysis to spot patterns and trends in the market that a human eye might miss.

Analyzing Trading Data

AI algorithms can analyze trading data to reveal patterns and trends that humans might miss. It can find trends that indicate the emergence of new trading opportunities and correlate cryptocurrency prices.

Sentiment Analysis

AI can look at how people feel about cryptocurrency in the news and on social media. Traders can benefit from sentiment analysis in two ways: first, by figuring out how prices might move, and second, by avoiding trades based on false or misleading information.

Natural Language Processing

Traders can benefit from artificial intelligence (AI) tools that use natural language processing (NLP) to keep up with breaking news and market trends easily. It is possible to extract essential details from articles and social media posts using natural language processing to spot newsworthy events. It can also spot hoaxes that could lead to poor investment decisions.

Identifying Market Trends

By analyzing past data, AI algorithms can predict future price changes in the market. It can also identify unusual trading patterns and notify investors of emerging opportunities.

Predicting Market Movements

AI can determine what will happen in the market by looking at market data for patterns that could mean price changes. Based on past data and current market tendencies, machine learning algorithms can forecast how prices will change.

In conclusion, AI changes cryptocurrency trading in a big way by making it easier to quickly and accurately analyze vast amounts of data. Traders can find more profitable opportunities and make more educated trades with the help of artificial intelligence tools like sentiment analysis, NLP, and machine learning algorithms. As AI technology improves, we can expect to find even more creative ways to use it in the future.

III. AI in Cryptocurrency: Trading Strategy Optimization

AI also makes it possible for trading strategies to change in revolutionary ways, a vital part of the digital currency market. Traders can benefit from the insights provided by AI algorithms that analyze historical data to determine optimal buy and sell signals.

Machine Learning for Trading Strategy Optimization

Algorithms that use machine learning can look at past trading data to find the best times to buy and sell. These algorithms can “learn” from previous trades and use that information to improve their forecasting abilities.

Automated Trading Based on Predetermined Strategies

Robotic intelligence can execute trades mechanically according to predefined rules. Programmable trading algorithms allow investors to automate transactions in response to predefined market conditions. Trading mistakes are also reduced or eliminated, saving time and effort.

Backtesting Trading Strategies

Artificial intelligence can also be used to “backtest” trading strategies to see how they would have fared under different market conditions in the past. Traders can determine how well different trading strategies worked in the past by looking at historical data.

Predicting Future Market Conditions

By analyzing market data and looking for patterns that could indicate price movements, AI algorithms can make predictions about the market’s future state. This data can help traders modify their trading approaches and make more educated trades.

Risk Management

AI can also help traders reduce risk by pointing out possible market risks and giving early warnings of losses. To reduce the likelihood of failures, traders must first be aware of the threats they face.

In short, AI is changing how people who work in finance make and use trading strategies. Using trading strategies improved by machine learning algorithms, traders can make better decisions and lose less money. AI aids traders in automating trades according to the predetermined plan and allows for better risk management.

IV. AI in Cryptocurrency: Risk Management

AI helps to avoid crypto bubbles. Trading cryptocurrencies can be risky because the market can change quickly, and there is a chance of fraud and other illegal activities. But AI can help reduce the risks of trading cryptocurrencies, making the process safer and more secure.

Analyzing Market Data

AI algorithms can analyze large amounts of market data to reveal threats and opportunities. Artificial intelligence can help traders by looking at patterns and trends in the market and giving them information about the market. AI can keep an eye on the cryptocurrency markets and let investors know when prices drop suddenly, so they can change how they invest.

Monitoring Trading Activity

AI can be used to keep an eye on trading activity and look for strange behavior that could be a sign of fraud or other illegal activity. Artificial intelligence can identify suspicious trading patterns and behaviors by analyzing historical data. This has the potential to shield investors from fraudulent trading and reduce losses.

Risk Assessment

Artificial intelligence (AI) can evaluate risk by scouring market data for danger indicators. This data can help traders modify their approaches to the market and cut down on losses. For example, traders can lower their risk by changing their strategies if AI finds an unusually high level of trading activity, which could signify that someone is trying to manipulate the market.

Fraud Detection

We cover this benefit when we read about AI in finance. By analyzing trading patterns and behaviors, AI can also be used to detect fraud. The ability of AI to spot warning signs during trades will do a lot to stop fraud and keep financial institutions and their customers from going broke. When AI spots a suspicious trading pattern that could be a sign of a “pump-and-dump” scheme, for example, traders can be warned of the risk and change their strategies to avoid it.

In conclusion, artificial intelligence is changing the way cryptocurrency traders handle risk. Artificial intelligence (AI) can aid traders by analyzing market data and monitoring trading activity to help them make more informed trading decisions and reduce losses. Traders can avoid risks and protect themselves from fraud by using AI to identify and stop suspicious trading activities.

V. AI in Cryptocurrency: Portfolio Management

Managing one’s cryptocurrency holdings can take a lot of work to keep up with multiple cryptocurrencies and adjust one’s portfolio based on how the market moves. However, AI can streamline this process and help traders earn more educated portfolio management decisions.

Analyzing Portfolio Data

AI algorithms can look at investment data, like how much cryptocurrency someone owns and what it is worth on the market, to help traders find places to diversify and rebalance their portfolios. Traders can use AI to look at market trends and patterns so that their portfolios align with their investment goals and how much risk they are willing to take.

Automating Portfolio Management Tasks

Portfolio management tasks like rebalancing and tax-loss harvesting can be automated with the help of AI. Because of this, investors can rest assured that their portfolios are set up for success while saving valuable time. Maintaining target allocations regardless of market fluctuations, or realizing tax losses from the sale of depreciated cryptocurrencies, are just two examples of how artificial intelligence can be used.

Machine Learning

Portfolio data can be analyzed with machine learning algorithms to forecast market movements. To help traders make more educated portfolio management decisions, AI can analyze past market data to predict future trends. For instance, machine learning algorithms can be used to forecast the future value of cryptocurrencies, giving investors a leg up on the market.

Risk Management

The dangers of portfolio management can also be mitigated with the help of AI. Artificial intelligence can aid traders in managing their portfolios more effectively by analyzing data to identify risks and vulnerabilities. Suppose AI determines that a portfolio has too much exposure to one cryptocurrency, for instance. In that case, it can warn investors about the dangers of doing so and offer advice on rebalancing their holdings.

In conclusion, AI is radically altering how cryptocurrency investors handle their holdings. AI can aid traders in making more informed decisions and maximizing returns on investments by analyzing portfolio data, automating portfolio management tasks, and managing risks.

VI. AI in Cryptocurrency: Trade Execution

AI has many possible uses in the financial industry, including but not limited to market analysis, portfolio management, and the efficient execution of trades with lower trading costs and less impact from slippage.

Analyzing Market Data

Algorithms based on artificial intelligence can look at market data and make trades based on price levels and technical indicators. Artificial intelligence (AI) can improve the efficiency with which transactions are executed, and opportunities are taken by learning from market data in the past.

Reducing Trading Costs

AI can also be used to lower trading costs. It can do this by analyzing market data and making trades at reasonable times. AI can help traders get better execution prices and lower costs by making slippage less of a problem.

Automation

Because AI makes it possible to automate trade execution, traders can take advantage of real-time opportunities without constantly watching the market. Using AI, you can set up trades automatically when certain market conditions are met, like when the price of a specific cryptocurrency hits a certain threshold.

Backtesting

Backtesting is a way to determine if a trading strategy is good upon seeing how it would have worked in the past. AI can also be used to test past trading strategies and figure out the best trading parameters. By simulating trades with historical data, AI can help traders find potential flaws in their trading strategies and fix them to get the best results.

In short, AI is changing the game for traders by analyzing market data, lowering trading costs, and automating trade execution. Traders can improve their returns and experience higher execution quality by taking advantage of AI’s potential.

VII. AI in Cryptocurrency: Market Making

AI technology and trade execution can also help with market making, adding liquidity to the market and lowering the bid-ask spread. The profits of market makers come from buying and selling assets at slightly different prices and pocketing the difference.

Analyzing Market Data

AI algorithms can spot inefficiencies and lucrative opportunities by poring over market data. Artificial intelligence can help market makers provide liquidity by analyzing the number of trades and finding market trends and patterns.

Providing Liquidity

Market makers provide liquidity by placing buy and sell orders at slightly different prices to close the gap between the ask and bid prices. Automating this process with AI enables market makers to react swiftly to shifting market conditions by analyzing market data and placing orders in real-time.

Automation

Market-making activities, such as placing buy and sell orders in response to real-time market data, can be automated with the help of AI. By automating these steps, market makers can respond more quickly to changes in the market and meet the demand for liquidity better.

Risk Management

Risks in market making, such as price volatility and counterparty risk, can be mitigated with the help of AI. By analyzing market data and looking for potential threats, artificial intelligence (AI) can help market makers manage their risk exposure and make trading decisions that will make them money.

In conclusion, AI is revolutionizing cryptocurrency market-making by analyzing data, providing liquidity, automating trading tasks, and managing risk. Market makers can cut down on bid-ask spreads and make more money by making their liquidity provision more efficient with AI.

VIII. AI in Cryptocurrency: Customer Service

AI-powered tools are being added to cryptocurrency trading platforms to improve customer service, automate boring tasks, and improve the user experience. Examples of how artificial intelligence (AI) is changing cryptocurrency trading customer service:

- Automated customer service: Artificial Intelligence in cryptocurrency boosts customer service. AI-powered chatbots and voice assistants can provide automated, always-on customer support. Traders can get real-time assistance from these chatbots, which can answer their questions and provide them with data on market trends and prices.

- Personalized recommendations: The user’s trading history and risk tolerance can be factored into AI-generated trading recommendations and investment strategies.

- Fraud detection and prevention: Artificial intelligence can help find and stop fraud by spotting trading or transactions that could be fraudulent. Artificial intelligence (AI) can find fraudulent activity and protect users from scams and other crimes by analyzing data patterns.

- Sentiment analysis: AI can analyze articles and social media posts to determine how the general public feels about a cryptocurrency or market trend. Traders can use this analysis to help them make better decisions and more accurately predict market movements.

- Improved engagement: The use of AI to customize the user experience has the potential to increase both engagement and loyalty. In the trading industry, for instance, AI algorithms can analyze user behavior to offer tailored trading advice, make investment recommendations, and recognize and reward dedicated account holders.

Generally speaking, Artificial Intelligence in cryptocurrency is doing magic in every aspect of trading. AI is radically altering the nature of customer service in the cryptocurrency trading industry. Artificial intelligence (AI) is assisting in boosting customer satisfaction and loyalty through the automation of tasks, the provision of personalized recommendations, and the detection of fraudulent activity.

IX. Conclusion

Potential AI advantages in cryptocurrency trading include time savings, lower risk, and more ways to make money. Artificial intelligence (AI) can also aid traders in spotting profitable trades in real-time, allowing them to stay one step ahead of the game.

The use of artificial intelligence in cryptocurrency trading has a promising future, and new developments in this area are likely to appear in the coming years. How cryptocurrency is traded is expected to change as AI technology, and cryptocurrency adoption rates increase. Accepters of AI in trading will likely gain an edge in the volatile cryptocurrency market.

FAQs

No single “best” AI crypto exists, as different cryptocurrencies may be better suited for other use cases or investment strategies. However, some popular AI-based cryptocurrencies include Fetch.ai, SingularityNET, and Numeraire.

Artificial Intelligence in cryptocurrency is doing magic. In cryptocurrency, AI aims to speed up processes like trade analysis, strategy optimization, risk management, and more. AI can help cryptocurrency traders and investors make better decisions and take advantage of new market opportunities.

Yes, AI is used in cryptocurrency for a variety of tasks, including trading analysis, strategy optimization, risk management, and more.

AI has the potential to significantly impact the cryptocurrency market by making it more transparent, reducing trading risks, and speeding up and improving the accuracy of market transactions. Further, cryptocurrency projects based on artificial intelligence are becoming viable investments.

AI is used in trading to analyze vast amounts of data, identify market trends and patterns, optimize trading strategies, automate trades based on predetermined conditions, and facilitate market making.

While artificial intelligence (AI) has many potential trading applications, it will likely be around for a while to replace human day traders. Instead, AI is more likely to work with human traders, enhancing both parties’ ability to see and capitalize on market intricacies.

Artificial intelligence can sort through vast amounts of data to find clues about how stock prices will change. It’s essential to remember that AI isn’t a crystal ball and can’t predict stock prices with 100% precision.

7 comments